09/09/2021 雅歌评论:黄金、原油、天然气、大盘走势短评 (完成) (谈股论金) 3007次阅读

观看【贴心小秘书】的博客天然气:

天然气昨天暴涨,非常意外,最大的可能是多头MM狙击逼空还是过多的空仓位。根据NGI开盘时也没总结出什么原因,盘后的看法是:

1. Natural gas futures on Wednesday rebounded as traders mulled ongoing production outages in the Gulf of Mexico (GOM), robust domestic demand and intensifying competition for U.S. exports of liquefied natural gas (LNG).

GOM production in the wake of Hurricane Ida, meanwhile, continued to only inch back toward normal. The bulk of GOM output remained shut-in Wednesday, with an estimated 77% of natural gas production still offline, totaling more than 1.72 Bcf/d, according to the Bureau of Safety and Environmental Enforcement.

Overall national output hovered around 91 Bcf at the start of trading Wednesday, more than 1 Bcf below pre-Ida levels due to the lingering shut-ins in the Gulf. While the storm diminished industrial demand for natural gas in the region as well, Wood Mackenzie analyst Kara Ozgen noted Wednesday “initial signs of comeback.”

At the pace established early this week, EBW Analytics Group said it will take another “28 days for currently shut-in Gulf of Mexico natural gas supply to stage a complete comeback.”

Entergy Corp. said Wednesday it has restored power to about 60% of the more than one million customers in Louisiana and Mississippi that lost service after Ida battered the two states. However, the company said, it may take until late September to fully restore power to all affected customers.

2. Bespoke Weather Services said forecasts Wednesday showed increased cooling degree days in the eastern half of the nation, adding to already robust demand in the West.

3. Spot gas prices skyrocketed Wednesday, as supply constraints and elevated demand in the western United States spurred a furious rally.

NatGasWeather said vast swaths of the West, along with the southern Plains and Texas, remain very warm to hot this week, with highs of upper 80s to 100s because of strong high pressure.

With lofty temperatures and high energy demand across the western region, the California Independent System Operator on Wednesday asked residents statewide to voluntarily conserve electricity in the afternoon and evening when the grid is most stressed because of higher demand and tighter supplies.

An energy storage facility in Moss Landing, CA, that was forced offline after it overheated and damaged batteries added to natural gas demand and upward price pressure out West.

Against that backdrop, physical prices spiked in California. SoCal Citygate jumped $8.495 day/day to average $20.055, while SoCal Border Avg. climbed $6.660 to $15.460.

Gains were also exceptionally pronounced in the Southwest, where high temperatures continued to eclipse the century mark in Las Vegas and Phoenix. El Paso S. Mainline/N. Baja advanced $16.000 to $28.765, and KRGT Del Pool gained $3.905 to $15.310.

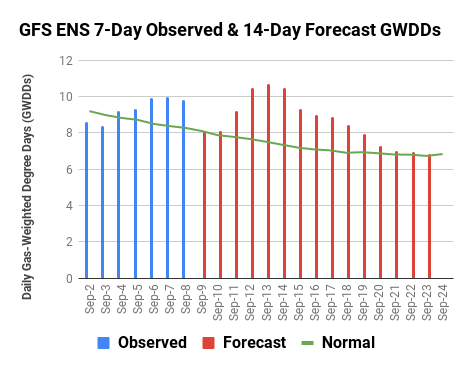

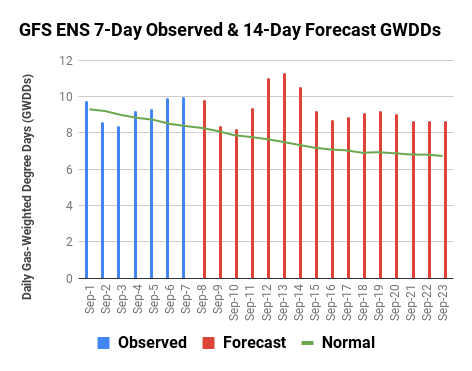

关于第二点, 今早的GFS预测已经改变, 下面是昨天和今早的预测,很明显看到18日以后的气温预测下调。

市场预估今天的报告是40BCF, NGI估计 是38BCF, 5年平均是65BCF。 如果没有出现意外利多的情形,比如少于30BCF,天然气价格应该要回落。

现货价格暴涨是反映当天或隔天的需求,发电厂若是没有足够的天然气库存,就必须在现货市场高价买进,不能无故停电。现货市场价格大涨多少会影响到期货市场的价格。现货市场的价格暴涨通常都是1-2日就回落。

操作建议:

天然气接近5美元是最近10年来最高的。

KOLD昨天跌至最低10.4元,应该是短期最低点。盘前虽然KOLD下跌一些,到了10.68元附近,俺认为不用惊慌,虽然昨天天然气暴涨幅度很大。德州和西部地区气温偏高,但日照时间比夏天减少1-2小时,天然气发电消耗量不会比7-8月份高。而且再过6-7日,最高气温会低于90度F。

天然气价格大幅度回落是寄望于9月底-10月份偏暖的气温。9月初气温偏热还是稍微利多,但10月份偏热,就是相当利空了。

KOLD暂时只能拿着。估计或许要等2周的时间才会回到14-15元之间。

短炒1-3日的,可以在11.3-12元之间卖出。

俺认为墨西哥湾海上平台虽然目前恢复的比较缓慢,但俺不认为需要再28天才会完全恢复!对于产油商,每一日没有产油,都是相当大的损失!

WTI 原油:

WTI原油昨天API的库存报告不如市场预期的减少那么多,今天EIA的报告估计会稍微利多,毕竟飓风IDA造成每日减产180万桶不是少数。所以原油今天可能测试70元。目前在69.72元附近。

操作建议:

俺认为70元以上可以做空原油。 IDA飓风的炒作今天可能就是到顶了!可以买进SCO在17-17.3元之间,目前大约在17.43元附近。

黄金,金矿股,美元指数:

美元指数昨天突破MA50(92.62),目前又跌破,回落到92.5附近。美元指数突然回落与大盘期货跌幅缩小有时间上的关系! 美元指数在过去18个月来,只要美股大跌就会大涨!去年一度涨到102以上,就是美股市大盘跌至最低时!

黄金今天反弹一些,但技术面还是利多。金价跌破MA200,就是2天前瞬间跌下来的,主要受到美元指数影响。大盘大跌,炒高美元,做空黄金和金矿股几乎变成固定的剧本。所有的技术面分析,其实都变得无关联!所有的支撑点或压力线都变成虚设的!

操作建议:

NUGT短期几天的区间是50-54元。NUGT50-51元之间可以稍微买进, 53元以上最后卖出,反过来买DUST。

如果大盘在未来2周内趋势是下跌的,似乎买DUST操作更好!NUGT有可能跌破50元到49元。

大盘走势:

Jim Cramer, 华尔街常年大牛昨天说股市在9-10月有6个忧虑,可能下跌。

当然有许多大牛继续高喊买进,股市会继续上涨。

昨天SPX一度跌破4500,到了最低4493点附近后反弹。收盘在4514附近.这表示有许多散户还是继续抄底,只要下跌就买进,因为这是过去18个月来的胜利方程式。如果股市是那么简单的话,所有炒股人都是百万富翁了!

操作建议:

今天SPX还是可能再次下探4500点。可能会跌破。 若是开盘上涨,可以稍微做空。

UVXY盘前一度到了 22.75元, 目前在22.17元附近。 俺认为可以在21.85-22。1元之间稍微买进。 22.7-23.2元之间卖出。

UVXY即使拿2周也没关系,剩下9个交易日到美联储开会时,股市很难创新高。恐慌情绪会偏高。 所以未来2周内UVXY有机会到25元以上。

完整帖子:

- 09/09/2021 雅歌评论:黄金、原油、天然气、大盘走势短评 (完成) - 贴心小秘书, 2021-09-08

![打开整个主题 [*]](themes/web_2.0/images/complete_thread.png)

- 黄金,金矿股指数GDX, NUGT/DUST讨论区。请点击后,发回复帖!NUGT/DUST单日涨跌幅最高过去是30%

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 贴心小秘书, 2021-09-08

- 贴心小秘书, 2021-09-08

- 原油期货,USO,UCO/SCO (2XETF),UWT/DWT (3X)讨论区. UWT/DWT 单日最大涨跌幅过去是30%

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 贴心小秘书, 2021-09-08

- 贴心小秘书, 2021-09-08

- 天然气期货和三倍的ETF UGAZ/DGAZ讨论区。单日涨跌幅过去最高是70%, 理论上可以高达100%

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 贴心小秘书, 2021-09-08

- 贴心小秘书, 2021-09-08

- UVXY/TVIX/SVXY、LABU/LABD、SOXL/SOXS TQQQ/SQQQ等3X ETF讨论区

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 贴心小秘书, 2021-09-08

- 贴心小秘书, 2021-09-08

- 中美股市走势讨论区

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 贴心小秘书, 2021-09-08

- 贴心小秘书, 2021-09-08

- 老师早, 大家早, 谢谢老师早评!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 小学生, 2021-09-09

- 小学生, 2021-09-09

- 雅歌老师早上好!谢谢老师。

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - Moyan, 2021-09-09

- Moyan, 2021-09-09

- Thank you so much!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - Gemi888, 2021-09-09

- Gemi888, 2021-09-09

- 谢谢老师!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 碧玉, 2021-09-09

- 碧玉, 2021-09-09

- 谢谢老师早评!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - NGO153, 2021-09-09

- NGO153, 2021-09-09

- Thank you very much!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - Ping2018, 2021-09-09

- Ping2018, 2021-09-09

- 谢谢老师早评!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - supernanny88, 2021-09-09

- supernanny88, 2021-09-09

- 老师早!非常感谢老师的早评!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - MBA, 2021-09-09

- MBA, 2021-09-09

- 谢谢老师早评!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 山高路远, 2021-09-09

- 山高路远, 2021-09-09

- 谢谢老师!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - 闪闪, 2021-09-09

- 闪闪, 2021-09-09

- 谢谢老师早评!

![空帖子 / 没有文字 [ 没有文字 ]](themes/web_2.0/images/no_text.png) - sva2017, 2021-09-09

- sva2017, 2021-09-09

- 黄金,金矿股指数GDX, NUGT/DUST讨论区。请点击后,发回复帖!NUGT/DUST单日涨跌幅最高过去是30%